Avoiding Herd Mentality: Why Following the Crowd Can Be Dangerous

“Everyone is buying it, so it must be a good investment.”If you’ve ever caught yourself thinking this, you’re not alone. It’s called herd mentality—and while it’s human nature, it’s also one of the most common reasons investors lose money. In investing, following the crowd often leads to entering late, buying high, and selling in panic…

Read morePOSTED BY

TrueXplano

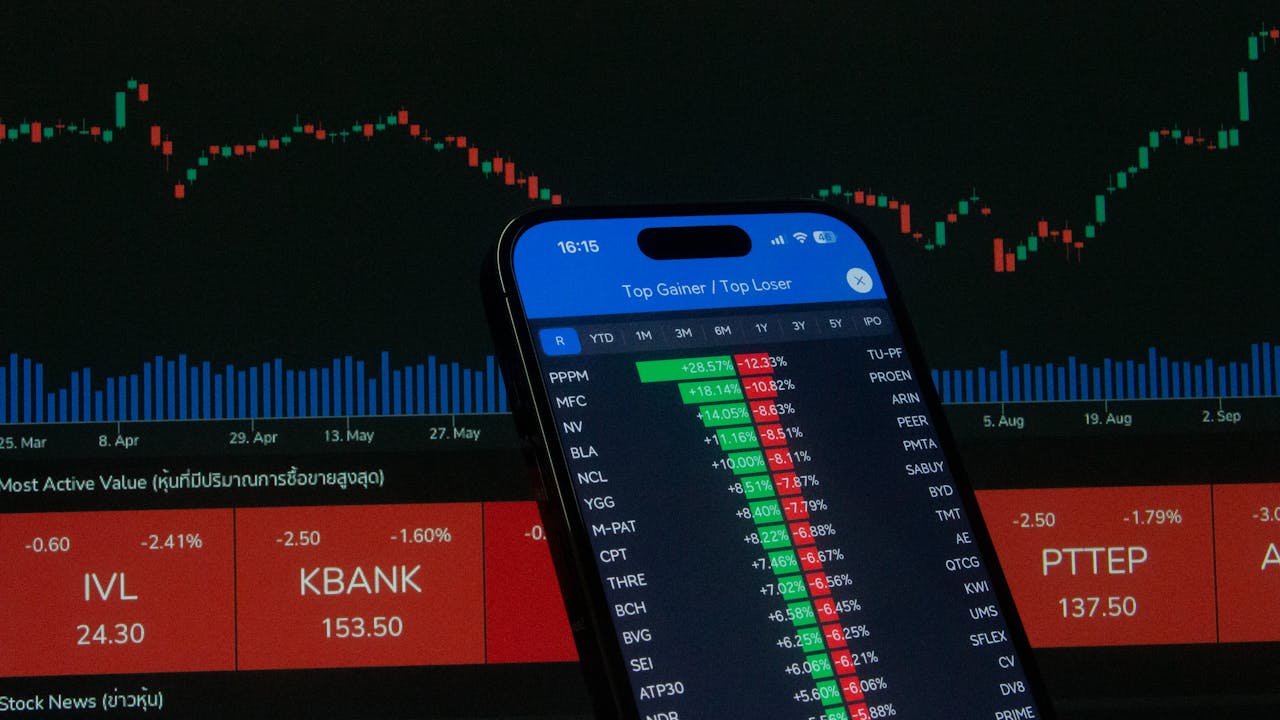

Creating an Investment Plan: Sticking to Strategy Amid Market Noise

In the investment world, noise is everywhere. It’s in the news headlines, viral tweets, panic-driven group chats, and overhyped YouTube videos telling you to “buy now” or “sell everything.” Amid all this noise, successful investors rely on one thing: a clear, well-defined investment plan. Your investment plan is your compass. It keeps you focused when…

Read morePOSTED BY

TrueXplano

Avoiding Herd Mentality: Making Independent Investment Choices

In the fast-paced world of investing, one of the most dangerous traps is the herd mentality—the instinct to follow what “everyone else” is doing. Whether it’s jumping on a hyped stock, rushing into a trending token, or selling in panic because others are, herd behavior often leads investors away from logic and toward poor decisions.…

Read morePOSTED BY

TrueXplano

Risk vs. Reward: How to Evaluate Investments Logically

In the world of investing, every opportunity comes with a trade-off. The potential to earn high returns is often shadowed by higher risk. Yet many investors focus on the reward while ignoring the risk. The key to long-term success lies in objectively weighing both—not chasing hype, but calculating value. Let’s explore how to evaluate risk…

Read morePOSTED BY

TrueXplano

Emotional Discipline in Investing: Building a Rational Decision Framework

Successful investing isn’t just about finding the right opportunities—it’s about managing yourself. The biggest threat to your portfolio often isn’t the market… it’s your emotions. Emotional discipline is what separates long-term investors from impulsive traders. It’s the ability to stick to your plan, stay calm in chaos, and avoid making snap decisions based on fear,…

Read morePOSTED BY

TrueXplano

The Psychology of Investing: How Emotions Sabotage Your Financial Decisions In 2025

Investing is as much a mental game as it is a numbers game. While spreadsheets, charts, and financial models offer the promise of rationality, the truth is many investors—new and experienced alike—make decisions that are driven more by emotion than logic. Understanding the psychology behind these emotions is the first step toward mastering them and…

Read morePOSTED BY

TrueXplano

How to Use Data and Research to Drive Investment Choices

Making sound investment decisions isn’t about gut feelings, market hype, or following influencers. It’s about one thing: information. More specifically, verified data and thorough research. Smart investors know that success in the market comes from informed decisions, not emotional reactions. In this post, we’ll break down how to use data and research effectively to make…

Read morePOSTED BY

TrueXplano

The Importance of Diversification: Don’t Put All Your Eggs in One Basket

If there’s one timeless truth in investing, it’s this: Never rely on a single asset to build your wealth. No matter how promising an opportunity seems, putting all your money into one stock, coin, or real estate deal exposes you to unnecessary risk. That’s where diversification comes in—a core strategy that separates long-term investors from…

Read morePOSTED BY

TrueXplano

The Role of Patience in Investment Success: Long-Term Thinking Over Quick Gains

In a world obsessed with instant results, patience is often overlooked—but in investing, it’s everything. Many investors enter the market dreaming of fast profits. They chase hype, jump between assets, and panic when prices drop. But history—and data—shows that the greatest investment success belongs to those who think long-term and act with patience. This post…

Read morePOSTED BY